GasBuddy

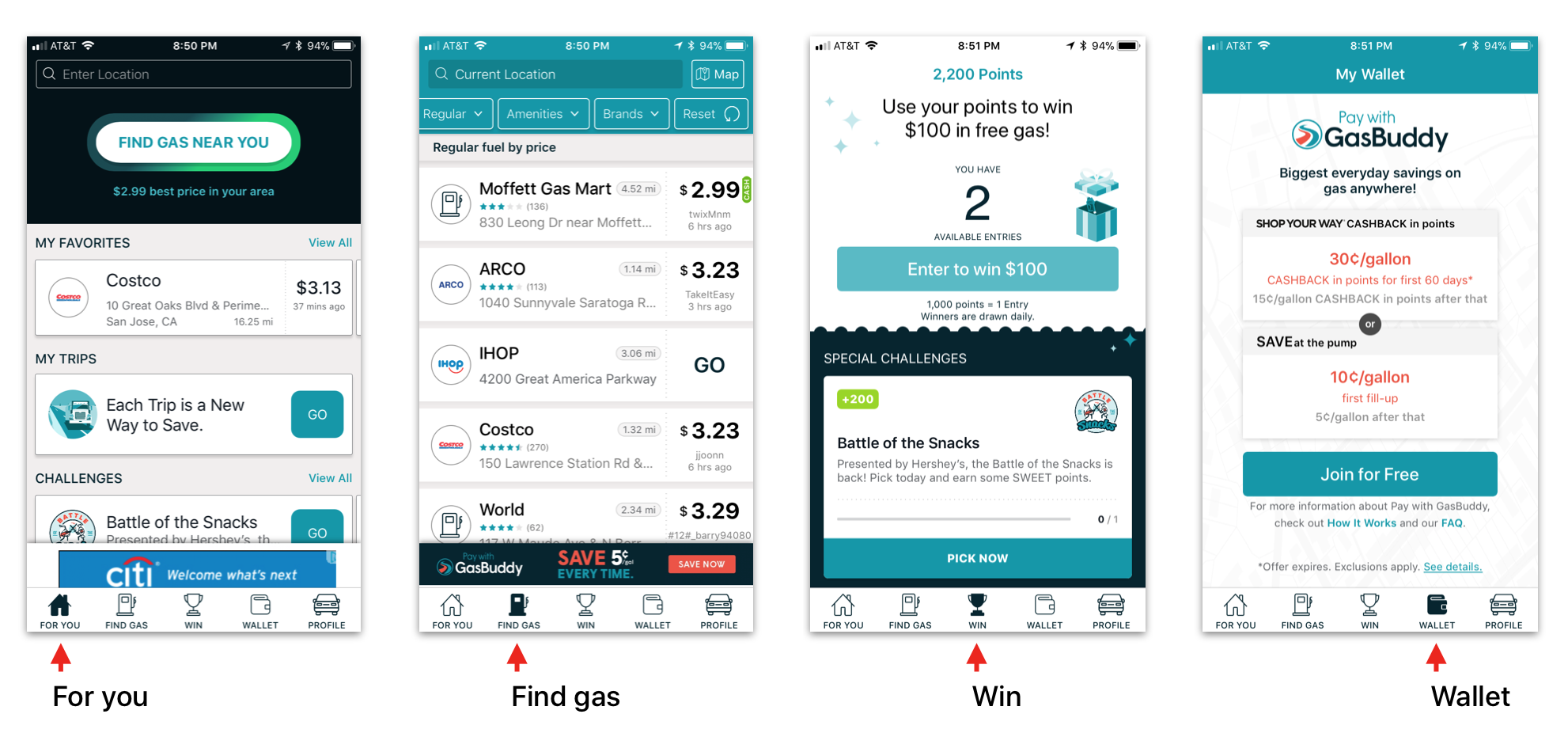

GasBuddy is a mobile app providing up-to-date local gas station prices. GasBuddy is very well known for their very up-to-date price data. Do they buy this data? No. All price data is crowdsourced by their power users. But, how?

Overview

GasBuddy wanted to know why their users are highly engaged with GasBuddy and what encourages their users to become power users. In addition, product design team also had a question why most of their new GasBuddy Debit Card Program(GDCP) users are power users.

Method

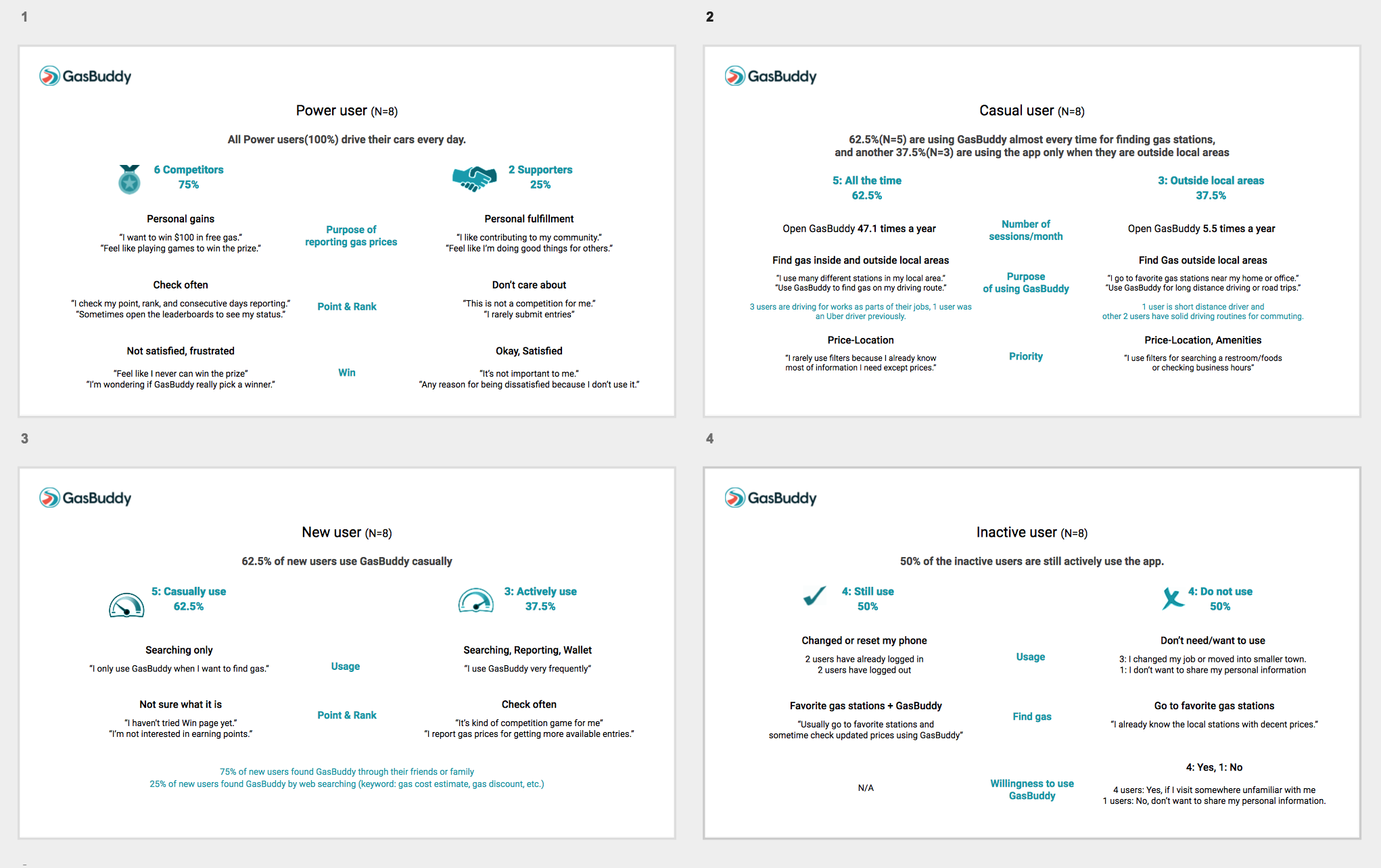

I ran four rounds of qualitative studies to uncover what's major difference between power vs casual users and planned user interviews with GDCP users across states to see how they've been using GDCP with GasBuddy app.

Details

Conducted user interviews combined with online surveys to get a better understanding of user journeys and see the difference of attitudes, behaviors, and expecations. Participants were categorized into 4 different groups(Power users, Casual users, New users, and Inactive users) by their GasBuddy propuct usage patterns and periods. I met 32 participants(12 in-person/20 remote sessions) from urban, suburb, and rural area across the US.

I had 40-min interviews to learn users' driving habits and GasBuddy mobile experiences. I planned interview questionnaires to understand why they come back to GasBuddy, when/how they use our app, and what they satisfied/dissatisfied with. The interview results were used to refine user personas and set a targeted marketing strategy for their new wallet experience and debit card program.

Study 2. GasBuddy payment (N=20)

Planned user interviews combined with online surveys to see how GasBuddy debit card users are using their cards with GasBuddy mobile app for their fuel purchases. Many participants brought up that information given during the onboarding process wasn't clear enough to understand what's the difference between old and new program. Because of this unclarity, new users were even more confused and it caused significant barriers to sign up for the new program.

To get more details of user contexts of onboarding experience, I designed a follow up study to learn their fuel-purchasing habits and related GasBuddy experience.

Methods

- Qualitative: user interview

- Quantitative: online survey and questionnaires